Britain’s economy may bear the brunt of the fallout from the UK’s decision to leave the European Union, but another part of the world — Africa — is set to be an unexpected victim.

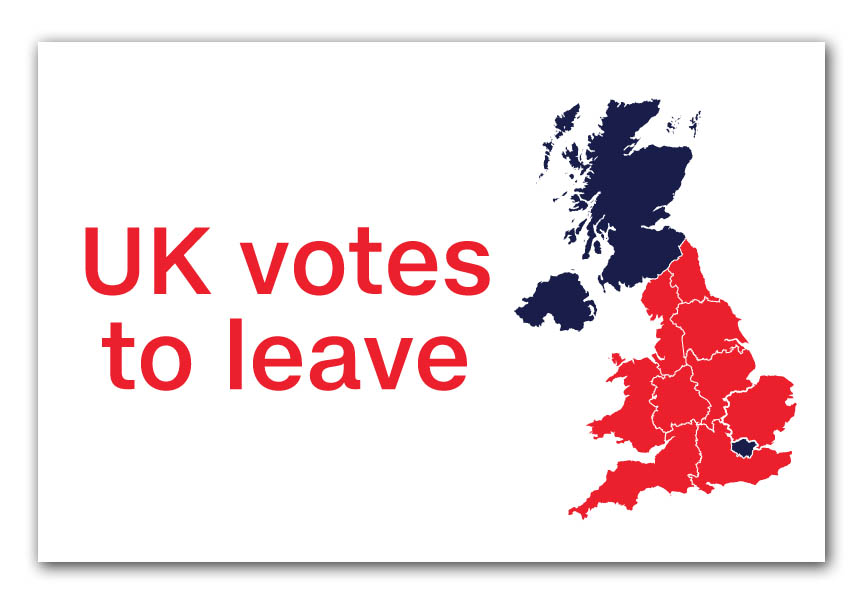

Much of the economic spotlight since Britain voted to leave the EU has understandably been trained on how the so-called Brexit vote will affect the British economy as well as those of countries within the eurozone and the wider European Union.

In the UK one word — recession — dominates, with banks, economic research houses, and supranational institutions all predicting that growth in Britain will shrink this year or next.

Barclays thinks the UK is on the “cusp of recession,” Credit Suisse predicts that a recession will cost Britain 500,000 jobs, and Morgan Stanley says a recession is coming, though it was unsure of the specific details.

It isn’t just predictions that are dire. Economic surveys, like Friday’s disastrous Markit flash PMI data, are also pointing to recession.

Europe is a slightly different story. Before the referendum it was generally accepted that a vote to leave would drag massively on growth and crush confidence, but so far the impact looks to be negligible, if surveys from the German think tank Ifo Institute and Markit are to be believed.

But according to new research from Barclays, Brexit’s economic impact on Africa, and particularly sub-Saharan Africa, or SSA, could be profound and incredibly damaging to the continent’s burgeoning development. In a note by analysts led by Peter Worthington, Barclays argues that the referendum will materially affect growth on the continent, saying:

“Post-Brexit, we see growth in sub-Saharan Africa halving to just 1.4% in 2016, the slowest pace in decades, due principally to sharply weaker growth outlooks in sub-Saharan Africa’s three biggest economies: Angola, Nigeria, and South Africa, which together account for nearly three fifths of SSA GDP.”

Barclays identifies seven key reasons SSA growth is at risk from Brexit. Take a look below:

- Brexit could harm global demand for goods, particularly hitting African economies that are focused on the export of raw materials. This would lead to “slower growth and wider current account deficits,” Barclays argues.

- Weaker global demand could also, Barclays says, cause key commodity prices to fall, further undermining the African economy, which relies heavily on exporting minerals, ores, and other commodities. The possible exception would most likely be gold, which has been boosted by market uncertainty since the referendum. Two of the world’s 10 biggest gold-producing nations are in sub-Saharan Africa.

- Tourism will dwindle. A key area of economic prosperity for African nations is tourism, particularly through safaris and other nature tours. The basic argument here is simple — if Brits and other Europeans are suffering through economic hardship, an African holiday will be far less affordable.

- Fewer African workers will be able to work in developed nations, which will reduce the amount of money sent back to SSA countries. As Barclays puts it, there will be fewer “economic opportunities for African migrants to the UK and Europe, and hence less workers’ remittances to home countries.”

- If things get really bad, aid from UK and European governments could start to dry up, robbing SSA countries of vital funding for infrastructure projects and other economically beneficial plans.

- Brexit is causing heightened uncertainty and, in some respects, increased risk aversion. These factors are likely to increase financing costs and shrink capital inflows into sub-Saharan Africa.

- Earnings on sub-Saharan investments into Europe and the UK will be lower. That is likely to have the biggest impact on sub-Saharan Africa’s most developed nation, South Africa, which has substantial investments in Europe.

Barclays said it was impossible to quantify exactly how big the impact would be (emphasis ours):

“Quantifying the aggregate impact of all these factors is challenging, especially because of the many feedback loops between financial markets and the real economy, and the interlinking second order, multiplier, and lagged effects as the Brexit shock reverberates across borders around the global economy. Moreover, even once the UK triggers Article 50 (the procedure to formally initiate divorce proceedings) it is likely to take at least two years to negotiate the terms of the UK’s exit from the EU. Until these terms are clear, the ultimate effect of Brexit will be obscured by much uncertainty.”