Business Insider/ Nigeria is finally going to do the painful thing everyone said it has to do.

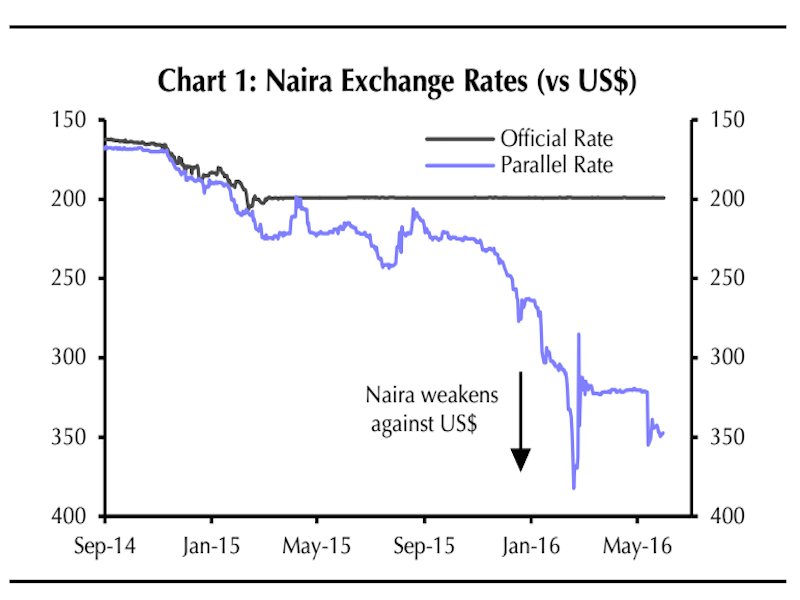

The central bank announced on Wednesday that the naira peg will be abandoned on Monday, June 20, and the currency will be allowed to float freely.

Although, Central Bank of Nigeria Governor Godwin Emefiele also said that the bank will intervene “as the need arises.”

As for what this means for Nigeria’s economy, in the short-term it’s going to get ugly. But in the long-term, things should start to pick up.

“Over the long-run, a weaker currency will help Nigeria’s economy by encouraging import substitution and attracting foreign investors, who have shunned the country for fear of a devaluation,” wrote Capital Economics’ Africa economist John Ashbourne in a note.

“But the move will be painful over the short term. Higher import prices will add to inflation, which reached 15.6% y/y in April. This will probably force the authorities to tighten monetary policy,” he added.

Plus, if Nigeria’s central bank can’t get inflation back under control, then the country might end up getting stuck in a “vicious” cycle of high inflation that leads to a weaker naira, noted Marc Chandler, the global head of currency strategy at Brown Brothers Harriman. And that, then, could lead to higher inflation.

“This is one reason why devaluations can be so painful, as central banks typically jack up interest rates afterwards. Recessions are often seen post-devaluation,” he wrote. “Yet if Buhari has finally relented on maintaining what we viewed as an unsustainable peg, the longer-term outlook for Nigeria will have improved.”

Analysts have long been arguing that Nigeria will eventually have to capitulate and devalue its currency given that the government’s controversial agenda of currency and price controls created a bunch of economic stresses in Africa’s largest economy. Most recently, inflation soared to a six-year high.

Still, devaluing the currency peg will not magically fix all of Nigeria’s problems.

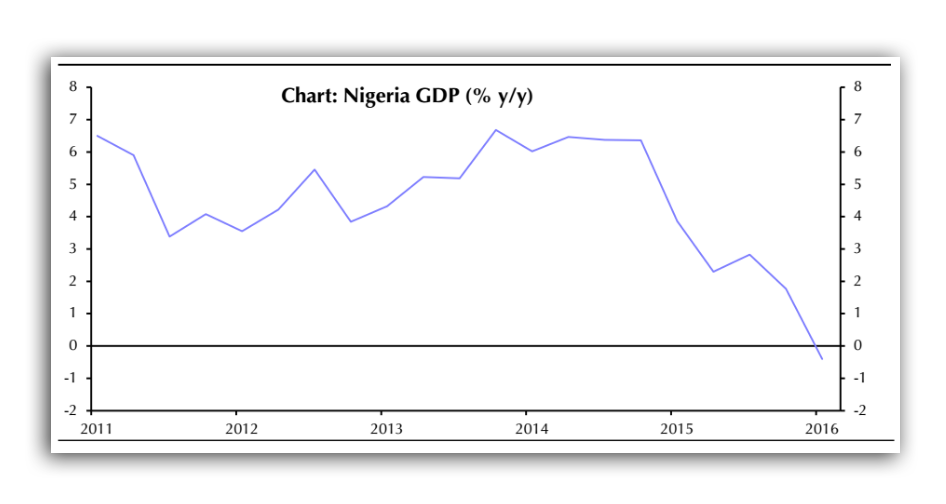

The country continues to suffer from numerous headaches, including lower oil prices, the fuel-shortage crisis, and ongoing oil-production disruptions by the Niger Delta Avengers. Plus, the Nigerian Bureau of Statistics recently revealed that the country’s economy shrank by 0.4% year-over-year in the first quarter, which was way worse than expected.

“A weaker currency is, at best, a necessary but insufficient condition of an economic recovery,” concluded Ashbourne.

But at least it’s a step in the right direction.