Foreign airlines flying to Nigeria have started to refuel abroad to bypass pricey, and increasingly scarce, jet fuel as the oil producer battles a hard currency shortage that has made fuel available only at a very high price.

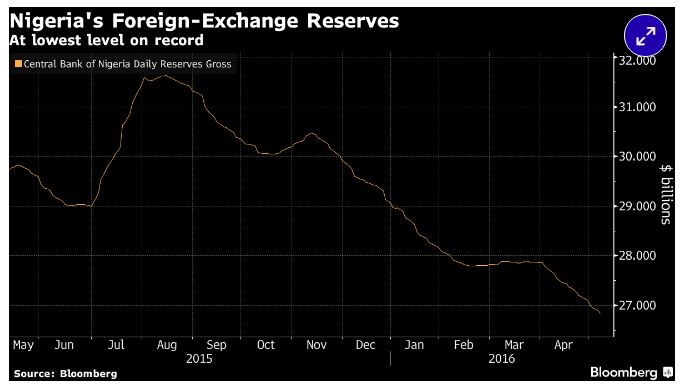

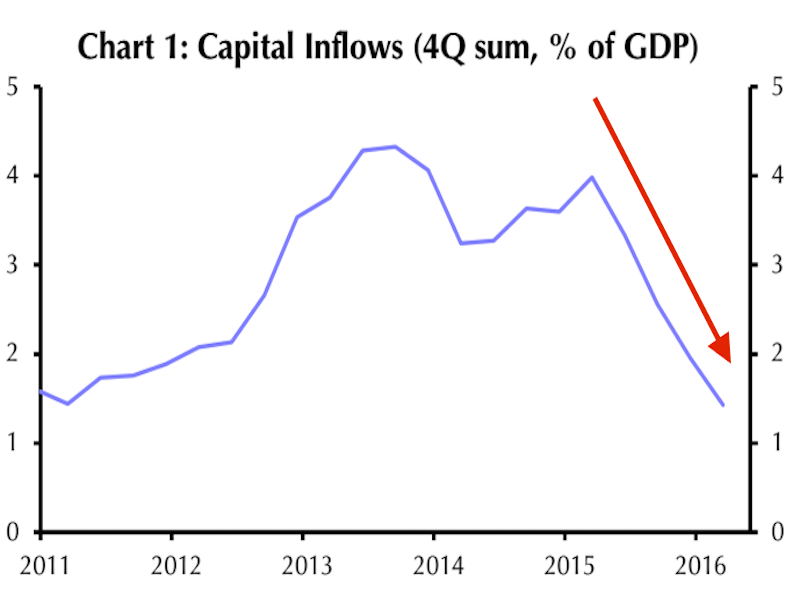

It is the second blow for airlines operating in Africa’s recession-hit biggest economy in a year that first saw the central bank make it almost impossible to repatriate profits from ticket sales as it tried to prevent a currency collapse.

The crash in the naira since a devaluation in June has led firms who market jet fuel locally, such as Total, Sahara and ConocoPhillips, to double the price to 220 naira a litre in August, and to as much as 400 naira this month, an airline executive said.

Even at the higher costs, marketers’ lack of dollars has made fuel scarce. Some carriers have had aircraft stuck, or were forced to cancel planned journeys, after frantic last-minute calls from ground staff warned there was no fuel available.

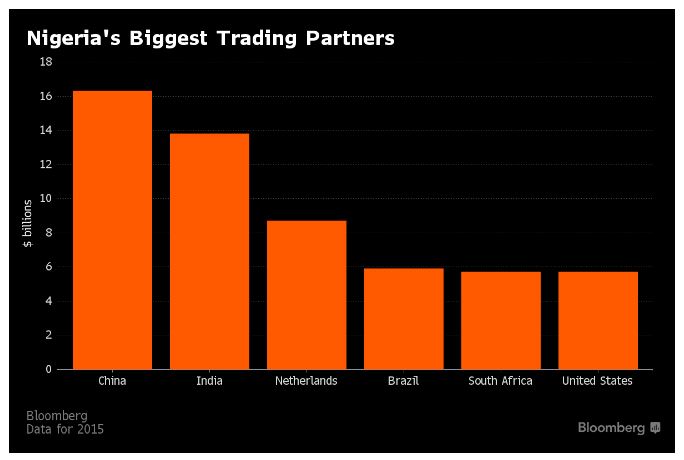

“The economy is crying out for investment, and now it is going to be even harder for anyone to visit,” said John Ashbourne, economist with Capital Economics. “Who is going to want to park a billion dollars in a country that you can’t even easily fly to? It sends the worst possible signal.”

A spokesman for state oil company NNPC did not answer calls for comment.

The central bank hoped floating the naira would attract dollar inflows, but the naira sunk by 50 percent, forcing oil firms to charge airlines, stuck with piles of naira, in dollars for jet fuel.

“It’s an impossible situation. The oil marketers don’t want to sign long-term agreements anymore so we have to accept whatever prices they demand,” one airline executive said. “We sell tickets in naira and now they want us to come with dollars.”

Spain’s Iberia and United Airlines cancelled their Nigeria services earlier this year, and two local carriers also halted operations. Other international airlines responded by boosting ticket prices within Nigeria, charging its globe-trotting elite as much as $2,000 for an economy class ticket to Europe to cut losses – more than double the cost of a Lagos ticket bought abroad.

WELL-HEELED PASSENGERS

Dubai-based Emirates has started a detour to Accra, Ghana, to refuel its daily Abuja-bound flight, a spokesman said. The airline already cut its twice-daily flights to Lagos and Abuja to just one.

The move was aided by a substantial drop in Ghana’s jet prices amid tax reform last month, according to the Ghana Chamber of Bulk Oil Distributors.

Air France-KLM said it had refueled abroad in “very exceptional cases” by juggling suppliers and stomaching extra costs.

Germany’s Lufthansa is loading more fuel in Frankfurt for its Lagos flight, where the ground staff doubt their ability to refuel for the final destination of Malabo, the capital of Equatorial Guinea, an executive said. The airline did not respond to official requests for comment.

The scarcity has even pitted airlines against local consumers; a surge in demand for cooking and heating kerosene during the rainy season, when households cannot easily burn wood or charcoal, means if the airlines do not pay up, marketers will sell to locals.

Airlines met with transport ministry officials last week in Abuja to press for fuel at lower prices, industry sources said.

Nigeria used to be one of the most profitable markets for foreign airlines, landing planes with plenty of first and business class to cater to executives and officials jetting around under former President Goodluck Jonathan.

President Muhammadu Buhari cut air travel allowances for officials in a bid to tackle graft; others simply have less spending power with consumer inflation running at an 11-year high of 17 percent.

British Airways, a popular choice for well-heeled Nigerians, said it is using smaller aircraft on its Lagos-London route, as did Air France-KLM.

Turkish Airlines’ use of smaller planes has added another inconvenience: passengers complained there is not always space for luggage on the smaller aircraft, delaying it for days. The airline did not respond to requests for comment.