DOHA, Qatar (AP) — A meeting of oil-rich countries in Qatar that had been expected to boost crude prices by freezing production fell apart Sunday as Iran stayed home and vowed to increase its output despite threats by Saudi Arabia.

Oil prices, which hit a 12-year low in January by dipping under $30 a barrel, had risen above $40 in recent days, buoyed by the bullish talks surrounding the Doha summit.

But instead of a quick approval of a production freeze, the meeting of 18 oil-producing nations saw hours of debate and resembled the dysfunction of an unsuccessful meeting of the Organization of the Petroleum Exporting Countries in December that sent oil prices tumbling.

The fact that producers couldn’t agree to a freeze, let alone a production cut, likely means oil prices will drop again as markets open Monday.

“Prices will trade lower. Maybe sharply lower,” said Robert Yawger, director of energy futures at Mizuho Securities USA, noting the failure to reach agreement in Doha.

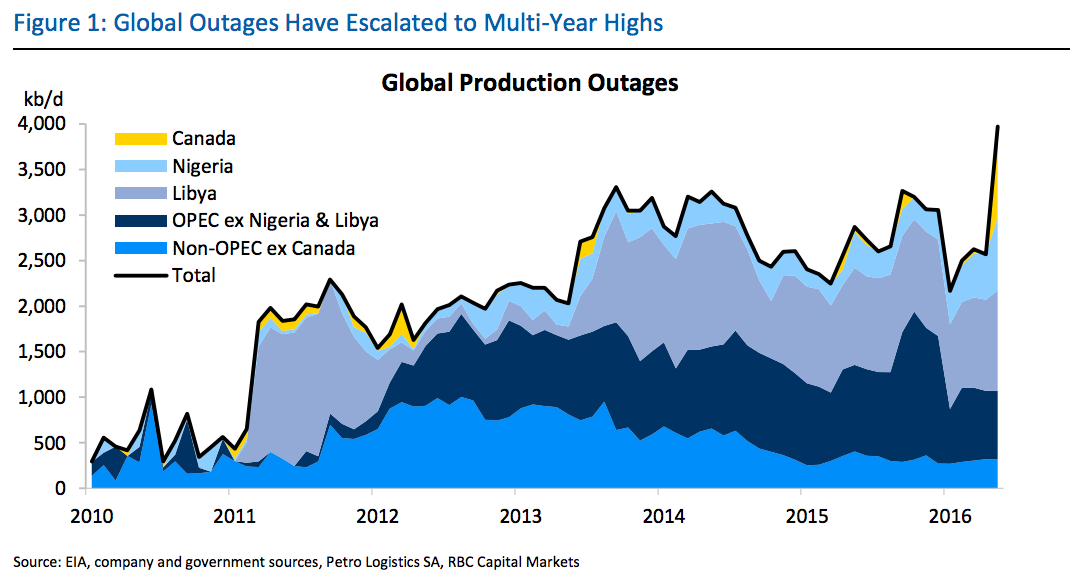

He noted that other factors were negatively impacting prices: U.S. crude oil storage remaining at all -time highs, Iran increasing production, and Libya looming on the horizon to boost output.

Speaking to journalists after the summit, Mohammed bin Saleh al-Sada, Qatar’s energy and industry minister, tried to say the lack of a decision showed officials believed “the fundamentals of the market are generally improving.”

However, he largely dodged the questions about whether another special summit will be called before OPEC’s next meeting in June and whether Iran had anything to do with the breakdown of the talks.

“We of course respect their position and … we still don’t know how the future will unroll but it was a sovereign decision by Iran,” said al-Sada, who is serving as OPEC’s president. “The freeze could be more effective definitely if major producers, be it from OPEC members like Iran and others, as well as non-OPEC members, are included in the freeze.”

Sunday’s gathering grew out a surprise Doha meeting in February between Qatar, Russia, Saudi Arabia and Venezuela, in which they pledged to cap their crude output at January levels if other producers did the same.

The idea of a freeze and not a cut initially looked more palatable to producers already suffering after oil’s dramatic fall since the summer of 2014, when prices were above $100 a barrel.

Production continues to rise as countries try to make up the difference. Ahead of Sunday’s meeting, Iraq boosted its production to record territory of over 4 million barrels a day in March, and Kuwait pumped 3 million barrels a day with homes of reaching 4 million a day by 2020.

And while car owners and airlines have enjoyed the low oil prices, the plunging oil revenues have wreaked havoc on countries like Nigeria and Venezuela, both of which attended Sunday’s meeting along with non-OPEC member Russia.

The biggest wild card of the talks, however, wasn’t even in the room. Iran decided to stay home late Saturday after saying the day before it would send an emissary to the meeting. Speaking to Iranian state television, Oil Minister Bijan Namdar Zangeneh said it didn’t make sense to send any representative from the Islamic Republic “as we are not part of the decision to freeze output.”

“We can’t cooperate with them to freeze our own output, and in other words impose sanctions on ourselves,” Zangeneh said.

With many international sanctions lifted under its nuclear deal with the U.S. and other world powers, Iran began exporting oil into the European market again and is eager to claw back market share. It produces 3.2 million barrels of oil a day now, with hopes of increasing to 4 million by April 2017.

Sunni-ruled Saudi Arabia had said it wouldn’t back any freeze if Iran, its Shiite rival, didn’t agree to it, throwing the deal into question before the meeting. The kingdom seems determined to ride out the low prices that could squeeze Tehran.

The enmity between Saudi Arabia and Iran has spiked in recent months.

In January, Saudi Arabia executed a prominent Shiite cleric, a move that sparked protests in Iran that saw demonstrators attack two of the kingdom’s diplomatic posts there. That broke the conflict between the two countries into the open, amid them backing opposing sides in both Syria’s civil war and the war in Yemen.

Saudi Oil Minister Ali al-Naimi repeatedly declined to speak to journalists during the meeting.

The dispute underscores the level of discord inside OPEC as it faces arguably its biggest challenge since the oil glut of the 1980s. Though more-costly U.S. shale oil production has dropped, it could re-enter the market if oil prices rise. And a large amount of crude already building up provides a major damper on prices, as does a generally weakened global economy, according to the U.S. Energy Information Administration.

The immediate effect of the summit’s collapse likely will be seen in crude prices. Western markets were closed Sunday and not immediately affected. Stock exchanges in Saudi Arabia and Dubai closed in negative territory Sunday, with the Saudi Tadawul down 1.48 percent.